If you want to do Vermont Business Entity Search to register new LLC, you need to choose a name that is not already being used by another company. This is important to avoid legal problems. Before you create a new Limited Liability Company (LLC) in Vermont, you should search to make sure the name you want to use is available and unique. This is called a business entity search.

I am an expert in helping people register new businesses and follow legal procedures. I can guide you through the best way to search for available business names in Vermont. This text will explain how to use the Vermont Secretary of State’s website to search for existing business names. It will also show you how to check if a business name is trademarked, & why it is important to do a thorough search before creating a new LLC in Vermont.

A Step-by-Step Guide to Starting Your Business in Vermont

Starting a business in Vermont involves several steps. First, you need to choose a name for your business and make sure it is available. You can check this by searching the Vermont business database. Next, you need to file the necessary paperwork with the state to officially register your business. This includes submitting articles of organization & paying any required fees.

After registering you will need to obtain any necessary licenses or permits to operate your business legally in Vermont. The requirements vary depending on the type of business you are starting. You may also need to register with the Vermont Department of Taxes to pay any applicable taxes such as sales tax or income tax.

Finally, you should consider other important steps like opening a business bank account, obtaining insurance, and creating an operating agreement if you have multiple owners. Following these steps carefully will help ensure you properly establish your new business in Vermont according to state laws and regulations.

Step 1: Search on Vermont Secretary of State’s Website

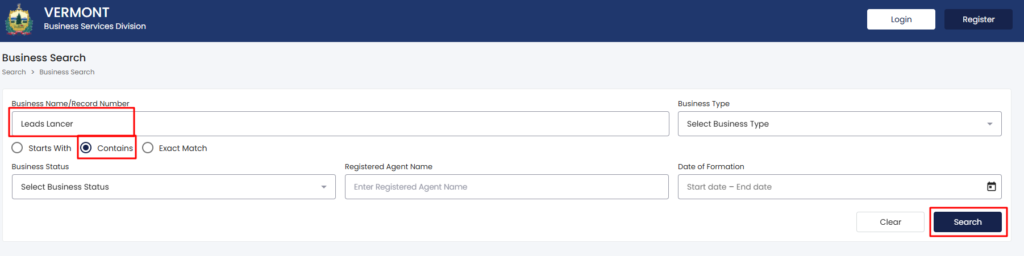

Access the tool that allows you to search for business names on the Vermont Secretary of State’s website. Type in the name of the LLC business you want to look up, for example Leads Lancer. Click the search button to start the search for the business name you entered.

If you see this option in the results, it means that the name you chose is available and you can proceed to register a Limited Liability Company (LLC) in the state of Vermont.

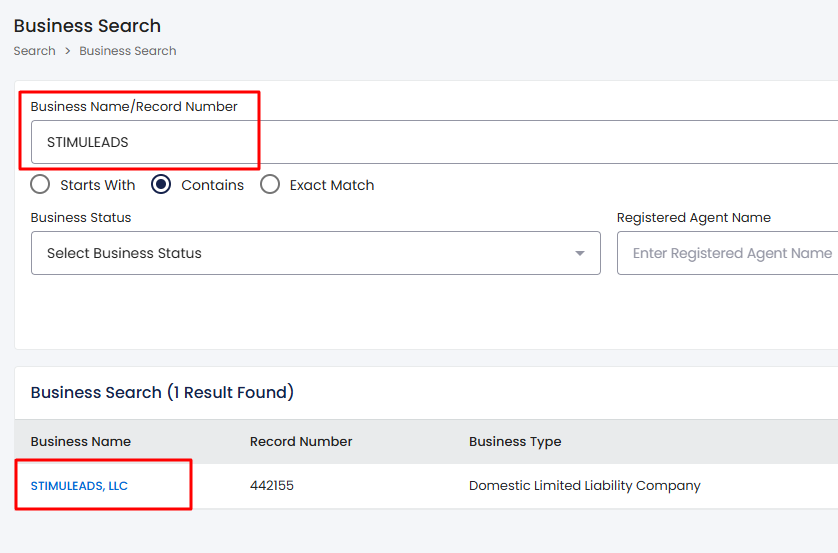

If you want to register a new Limited Liability Company (LLC) in Vermont, and your desired company name is STIMULEADS, you need to follow these steps:

First, go to the Vermont Secretary of State’s website and search for business names. This will show you if any existing companies have already registered a name similar or identical to the one you want. When you search, you may see some results appear. Carefully review these results to check if the exact spelling of your desired name STIMULEADS, is already taken.

If it is, you will need to choose a different name for your new LLC. The search tool on the website allows you to customize your search in various ways. You can search for names that contain specific words, start with certain letters or match your desired name exactly. Using these options can help narrow down your search and find available names more efficiently.

If your desired name is available, you can proceed with registering your new LLC under that name. However, if the name is already taken, you will need to come up with an alternative name that is not currently in use by another business in Vermont.

What if the Vermont Business Entity Name is already taken?

If the desired LLC name is already registered with the Vermont Secretary of State’s office, it means that another business entity has already claimed and secured that name. In such a case, you will need to choose a different name for your Limited Liability Company (LLC) that is unique & not currently in use.

The state requires each LLC to have a distinct name to avoid confusion and maintain proper records. You can search the database again to find an available name or modify your original choice by adding or changing words to make it unique. Having a unique name is crucial for establishing your LLC’s identity and complying with state regulations.

Vermont Business Entity Search by Email & Phone

Contact the State of Vermont To speak with someone or get help, call the Business Services Division of the Vermont Secretary of State. According to recent numbers from the Vermont Secretary of State’s office, businesses that directly contact the Business Services Division are 95% satisfied with the help they receive.

Their phone numbers are 802-828-2386 or 888-647-4582 (toll-free). This service is especially helpful for getting answers to questions or guidance on searching for an LLC name.

Email: CorporationsSupport@vermont.gov

Office hours: 9 am to 5 pm

How do I Reserve A Desired Vermont LLC Name?

You can reserve a desired Vermont LLC name if you do not plan to start the company right away. By reserving the name you ensure that no one else can use it for a certain period. This allows you to secure the name you want before officially forming your LLC.

To reserve a desired name for your Vermont Limited Liability Company (LLC), follow these steps:

1. Choose a unique name that complies with Vermont’s naming requirements. The name must include the words “Limited Liability Company” or the abbreviation “L.L.C.” or “LLC.” It cannot be the same as or too similar to an existing business name in Vermont.

2. Once you have selected a name you need to submit a Name Reservation Application to the Vermont Secretary of State’s office. This application can be filed online or by mail.

3. Along with the application, you must pay a non-refundable fee of $20. This fee covers the cost of reserving the name for 120 days.

4. If the name is available & meets all the requirements, the Secretary of State’s office will reserve it for your LLC. 5. After the 120 days, you can either file the Articles of Organization to officially form your LLC or renew the name reservation for an additional fee.

Remember, reserving a name does not automatically register your LLC. It simply holds the name for a limited time while you complete the remaining steps to officially establish your Vermont LLC.

Time and Cost

To officially establish your Limited Liability Company (LLC), you need to submit the Articles of Organization to the Vermont Secretary of State’s office. This document is crucial as it legally creates your LLC. You can file the Articles of Organization online through the Vermont Business Portal. The filing fee is $125, and the processing time is typically within 1-2 business days. Once the state approves your filing, your LLC will be officially formed and recognized as a legal business entity in Vermont.

Appoint a Registered Agent

Appoint a Registered Agent. Your Vermont LLC needs a Registered Agent. This person or company receives legal documents on behalf of your business. Requirements: – The Registered Agent must live in Vermont or be a business allowed to operate in Vermont. – The Registered Agent must have a physical address in Vermont (not a P.O. Box).

You can be your Registered Agent or hire a professional Registered Agent service.

Register for Vermont State Taxes & Business Licenses

Navigating Vermont’s business licenses and tax registration can seem overwhelming, but with a step-by-step guide, the process can be much more manageable.

First, determine the type of business you will be operating and research the specific licenses and permits required for that industry.

Next, register your business with the Vermont Secretary of State and obtain a federal Employer Identification Number (EIN) from the IRS. Then, you’ll need to register for state taxes with the Vermont Department of Taxes and obtain any necessary local permits.

Finally, make sure to stay informed about any ongoing reporting and compliance requirements to ensure that your business remains in good standing with the state.

By following these steps, you can successfully navigate Vermont’s business licensing and tax registration process.

Open a Business Bank Account

When registering for a business in Vermont, one crucial step to ensure smooth financial transactions and maintain a clear distinction between personal and business finances is to open a dedicated business bank account. This not only helps in managing your business finances more efficiently but also plays a critical role in legal and tax-related matters. To open a business bank account in Vermont, you will need several key documents:

An Employer Identification Number (EIN), which acts as a federal identifier for your business, and the LLC Approval Document issued by the Vermont Secretary of State confirming your business’s legal status. Additionally, depending on the bank’s requirements, you may also need to provide an Operating Agreement.

This agreement outlines the management structure and operational procedures of your LLC and is essential for banks that require detailed documentation about your business’s operational framework. Having a separate business bank account simplifies accounting, enhances credibility, and may be required by some financial institutions as part of their due diligence. It’s important to choose a bank that understands the needs of small businesses and offers services that align with your business goals, such as online banking facilities, minimal fees, and easy payment solutions (Hatten, 2022).

How to Find Existing LLC Owner Contact Details

Locating the contact information for the owners of an existing Limited Liability Company (LLC) can be a straightforward process. Here are the steps to follow:

1. Identify the state where the LLC is registered: LLCs are formed and registered at the state level, so you need to determine which state the company is registered in.

2. Visit the state’s Secretary of State website: Each state has an online database or registry where business entities, including LLCs, are listed. These websites typically provide access to public records & filings related to the LLC.

3. Search for the LLC: On the Secretary of State’s website, look for a search function that allows you to search for the LLC by its name or registration number. This search should provide you with the LLC’s filing details.

4. Review the LLC’s filing information: Once you have located the LLC’s filing, look for sections that list the names & addresses of the company’s owners, managers, or members. This information is typically required to be disclosed as part of the LLC formation process.

5. Obtain contact details: The filing may directly provide contact information, such as mailing addresses or email addresses, for the listed owners or managers.

If not, you can use the provided addresses to attempt to reach out to the owners through other means, such as mail or online searches. It’s important to note that the availability and accessibility of LLC owner contact details may vary depending on the state’s laws and regulations.

Some states may have stricter privacy laws that limit the amount of personal information disclosed in public filings. If you are unable to find the desired contact information through the state’s official channel, you may need to explore alternative methods, such as hiring a professional service or consulting with a legal professional familiar with the specific state’s LLC laws.

If you want to learn it step by step, you can Click Here and read the complete article about this.

Conclusion

Finishing the process of creating a Limited Liability Company (LLC) in Vermont is simple if you follow the correct steps. By searching for existing business names, submitting the necessary paperwork, and obeying state laws, you can successfully start your business in Vermont.

Do you need assistance? Contact Us for business services to find more information. Would you like a PDF version of this guide or any changes to be made?

0 Comments