The Alabama Business Entity Search process is a crucial step for anyone looking to establish a business in the state. Conducting a thorough search allows individuals to check the availability of their desired business name, as well as to ensure that there are no existing entities with similar names. This process is typically carried out through the Alabama Secretary of State’s website, where individuals can access the business entity database and perform a search using various parameters such as entity name, type, and status.

Understanding this process is essential for anyone looking to start a business in Alabama, as it sets the foundation for the legal and operational aspects of the entity. When embarking on the Alabama Business Entity Search process, it’s important to be diligent and meticulous. This involves not only checking for name availability but also ensuring that the chosen business entity aligns with the individual’s long-term goals and objectives.

Additionally, understanding the nuances of the search process can help individuals navigate potential roadblocks and ensure a smooth and efficient registration process.

Key Points Alabama Business Entity Search

1: Conducting a business entity search in Alabama is crucial for making informed decisions about the right business entity for your needs.

2: Factors to consider when choosing a business entity in Alabama include liability protection, tax implications, and management structure.

3: Alabama offers various types of business entities, such as sole proprietorships, partnerships, LLCs, and corporations, each with its pros and cons.

4: Navigating the legal requirements for business entities in Alabama requires careful consideration of state regulations and compliance obligations.

Seeking professional guidance can help you navigate the complexities of choosing the right business entity in Alabama and ensure compliance with state laws.

The Importance of Conducting a Business Entity Search in Alabama

| Reasons to Conduct a Business Entity Search in Alabama | Benefits |

|---|---|

| Verify Business Existence | Ensures the business is legally registered and active |

| Legal Compliance | Helps in understanding the legal status and compliance of the business |

| Business Name Availability | Allows to check if the desired business name is available for registration |

| Identify Business Owners | Provides information about the owners and key personnel of the business |

| Protect Your Business | Helps in avoiding confusion with existing businesses and protects your brand |

Alabama Business Entity Search: A Step-by-Step Guide

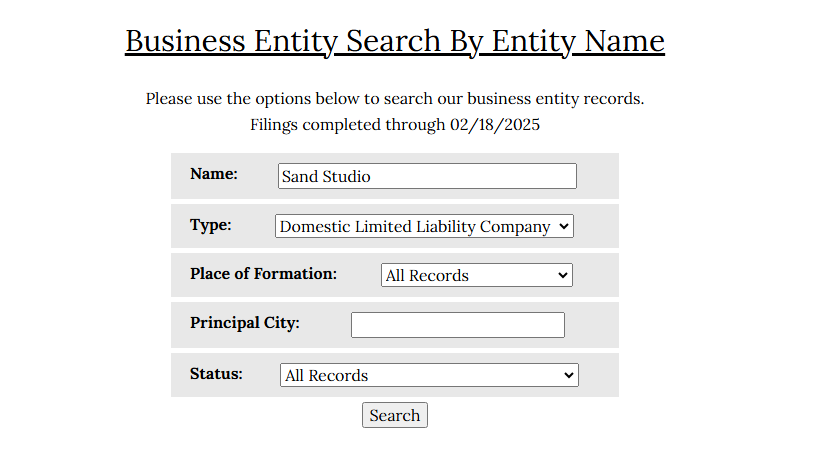

Go to the website of the Alabama Secretary of State. This website allows you to check if a business name is available for registration. Let’s say you want to start a new Limited Liability Company (LLC) and you want to name it “Sand Studio“. You can enter this proposed name on the website to see if it is available for use or if it is already taken by another business.

You can search to see if any existing limited liability companies (LLCs) have the same name you want to use. If your desired name does not appear in the search results it means that name is available for you to register a new LLC with that name.

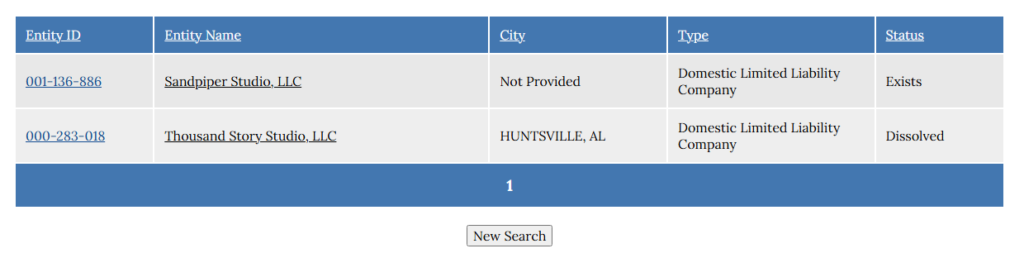

Sand Studio, LLC is an available name, and you can register your limited liability company (LLC) with this name. When searching for “Sand Studio,” there are two records that include the word “sand,” but not the exact phrase “Sand Studio.” The records found are “Sandpiper Studio LLC” and “Thousand Story Studio LLC.” Since there is no existing LLC with the name “Sand Studio, LLC,” you can proceed to register your company under this name.

What if my desired LLC name isn’t available?

If the name you want for your Limited Liability Company (LLC) is already taken, you will need to choose a different name or add a variation to make it unique. It’s important to have a distinct name for your LLC. Before finalizing your LLC name and applying for an Employer Identification Number (EIN) or purchasing any marketing materials, it’s wise to wait until your LLC is officially approved. This way you won’t waste money on supplies that you can’t use if your desired name is unavailable.

If you’re unsure about the availability of your chosen name, you can contact the Secretary of State’s office in your state. In Alabama for example, the representatives can assist you in using the Alabama Business Name Search to check if your desired name is available. However, they cannot guarantee that your name will be approved, but this service can help you understand the process. The phone number for the LLC Department in Alabama is (334) 242-7200, & their operating hours are from 8 am to 5 pm Central Time, Monday through Friday.

Factors to Consider When Choosing a Business Entity in Alabama

When choosing a business entity in Alabama, several factors come into play. One of the primary considerations is the level of personal liability protection that the entity provides. For instance, forming a limited liability company (LLC) or a corporation can shield personal assets from business liabilities, offering a layer of protection for the business owner.

Additionally, tax implications play a significant role in entity selection. Different business structures are subject to varying tax treatments, and selecting the right entity can result in substantial tax savings for the business. Moreover, the ease of formation and ongoing compliance requirements should be taken into account.

Some entities, such as sole proprietorships and partnerships, have minimal formalities and paperwork, making them relatively easy to establish. On the other hand, corporations and LLCs entail more complex formation processes and ongoing compliance obligations. Understanding these factors is crucial for making an informed decision when choosing a business entity in Alabama.

Types of Business Entities in Alabama: Which One is Right for You?

Alabama offers several types of business entities, each with its own set of advantages and disadvantages. Sole proprietorships are the simplest form of business and are owned and operated by a single individual. Partnerships, on the other hand, involve two or more individuals who share ownership and management responsibilities.

Limited liability companies (LLCs) are popular due to their flexibility and liability protection, while corporations provide a separate legal entity status and potential tax advantages. Choosing the right business entity in Alabama depends on various factors such as the nature of the business, long-term goals, tax considerations, and personal liability concerns. For instance, a small, service-based business may find a sole proprietorship or an LLC suitable due to their simplicity and tax benefits.

Conversely, a high-growth tech startup may opt for a corporation to attract investors and take advantage of favorable tax treatment. Understanding the nuances of each business entity type is essential for making an informed decision that aligns with the specific needs of the business.

Comparing Business Entities in Alabama: Pros and Cons

Sole Proprietorships and Partnerships

Sole proprietorships offer simplicity and full control, but they also expose owners to unlimited personal liability. Partnerships, on the other hand, allow for shared management, but they also entail shared liabilities among partners.

Limited Liability Companies (LLCs)

Limited liability companies (LLCs) provide liability protection and flexibility, but they may have higher administrative requirements.

Corporations

Corporations offer separate legal status and potential tax advantages, but they involve more complex formation and ongoing compliance obligations.

Making an Informed Decision

By comparing the pros and cons of these entities, individuals can assess which structure aligns best with their business goals, risk tolerance, and long-term vision.

Key Considerations for Establishing a Business Entity in Alabama

Establishing a business entity in Alabama requires careful consideration of various key factors. These include selecting an appropriate business name that complies with state regulations and accurately reflects the nature of the business. Additionally, determining the ownership structure, management responsibilities, and initial capitalization are crucial steps in entity formation.

Moreover, individuals must comply with state-specific registration requirements, obtain necessary licenses or permits, and fulfill any tax obligations associated with their chosen business entity. Understanding these key considerations is essential for navigating the establishment process effectively and ensuring compliance with legal and regulatory requirements.

Navigating the Legal Requirements for Business Entities in Alabama

Navigating the legal requirements for business entities in Alabama involves understanding state-specific regulations, compliance obligations, and ongoing reporting requirements. Depending on the chosen entity type, individuals must adhere to formation procedures outlined by the Alabama Secretary of State’s office, including filing articles of organization or incorporation. Additionally, ongoing compliance obligations such as annual reports, tax filings, and maintaining proper corporate records must be met to ensure legal standing and good standing status within the state.

By navigating these legal requirements effectively, businesses can operate within the bounds of the law and maintain good standing with state authorities.

Alabama Business Entity Search: Tips for Finding the Right Fit

When conducting an Alabama Business Entity Search, several tips can help individuals find the right fit for their business needs. It’s advisable to brainstorm multiple name options before initiating the search process to increase the likelihood of finding an available name that resonates with the business’s identity. Furthermore, considering future expansion plans or changes in business activities can help individuals select an entity that accommodates growth and evolution over time.

Seeking professional guidance from legal or financial advisors can provide valuable insights into entity selection and ensure compliance with state regulations.

Seeking Professional Guidance for Choosing a Business Entity in Alabama

Seeking professional guidance when choosing a business entity in Alabama can provide invaluable support and expertise throughout the decision-making process. Legal professionals specializing in business law can offer insights into liability protection, tax implications, and compliance requirements associated with different entity types. Additionally, financial advisors can provide guidance on structuring ownership arrangements, capitalization strategies, and financial planning within the chosen entity structure.

By leveraging professional expertise, individuals can make well-informed decisions that align with their business objectives while navigating complex legal and financial considerations effectively.

If you need help with LLC lookup, business entity searches, or finding accurate contact details, we’re here to assist you. Our expert research services ensure you get verified business owner information quickly and efficiently. Contact us today for reliable data and tailored solutions for your needs!

0 Comments