How to Pay Property Tax in St. Louis County Introduction Paying property tax is an important responsibility for property owners in St. Louis County. This guide will provide you with clear and straightforward instructions on how to pay your property tax using the personal, business search with Locator Number, Name, Property Address and Subdivision Name. Here’s a comprehensive guide to help you navigate the payment procedures effectively.

Understanding Property Tax Obligations

Personal Property Taxes: Personal property taxes are a type of tax levied on items that individuals own, such as vehicles, boats, and certain types of equipment. These taxes are separate from real estate taxes, which are imposed on land & buildings. The purpose of personal property taxes is to generate revenue for local governments to fund public services and infrastructure. Typically, personal property taxes are calculated based on the assessed value of the taxable items. Local tax authorities determine the assessment process, which may involve considering factors like the age, condition and market value of the property.

Real Estate Property Taxes: Property taxes are a type of tax levied on real estate, which includes land and any buildings or structures on it. These taxes are typically imposed by local governments such as cities, counties, or municipalities, and are used to fund various public services & infrastructure projects. Property taxes are calculated based on the assessed value of the property, which is determined by local tax assessors. The assessed value is usually a percentage of the property’s fair market value, and it takes into account factors such as the size of the property, its location and any improvements or renovations made to it. Property owners are required to pay their property taxes regularly, usually annually or semi-annually.

The amount you pay is based on the value of your property, which is determined by an assessment. Property taxes help fund important services in your community, such as schools, roads & emergency services.

How to look up property tax in St. Louis County?

To find information about property tax in St. Louis County, go to the St. Louis County Property Tax website. This online portal allows you to view your tax statements & see the history of your property tax payments.

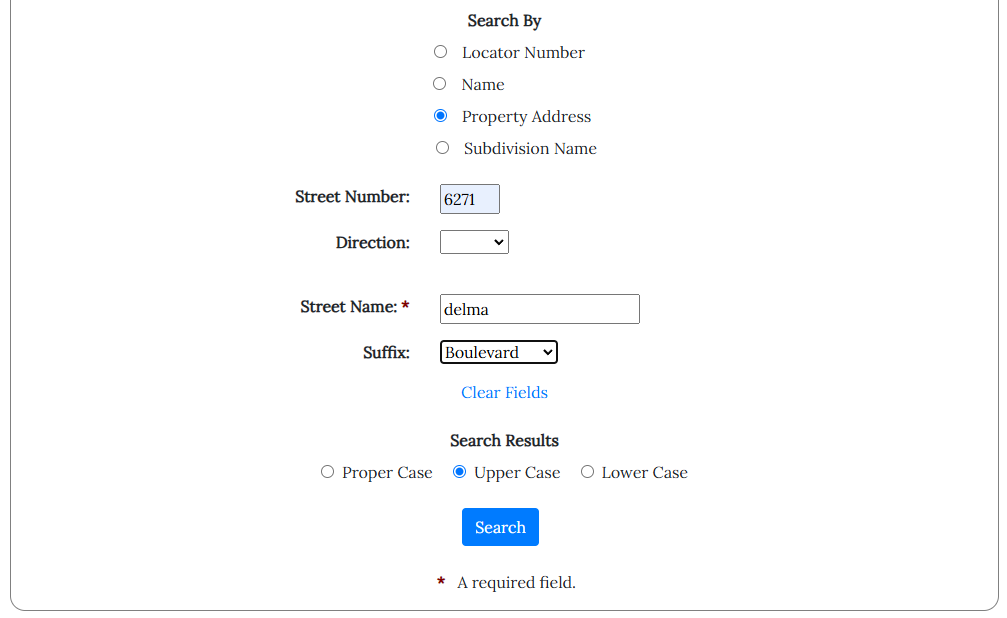

For example, you need to find the property address of 6271 Delmar Blvd, University City, MO 63130, you need to enter this address into a website.

Enter “6271, in the street number, in street name write the name of the street “Delma”, select the Suffix Boulevard, & hit enter or click the search button. The website will then display information and details about the property at that address, such as its location on a map, property details, and potentially other relevant information.

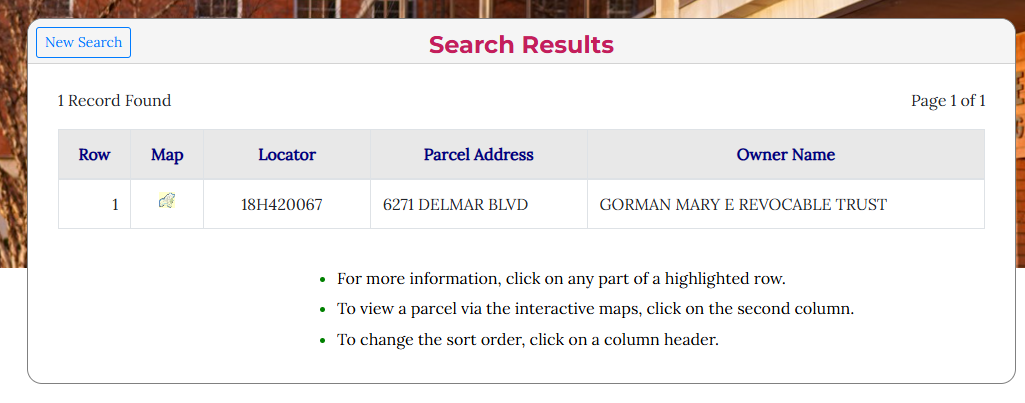

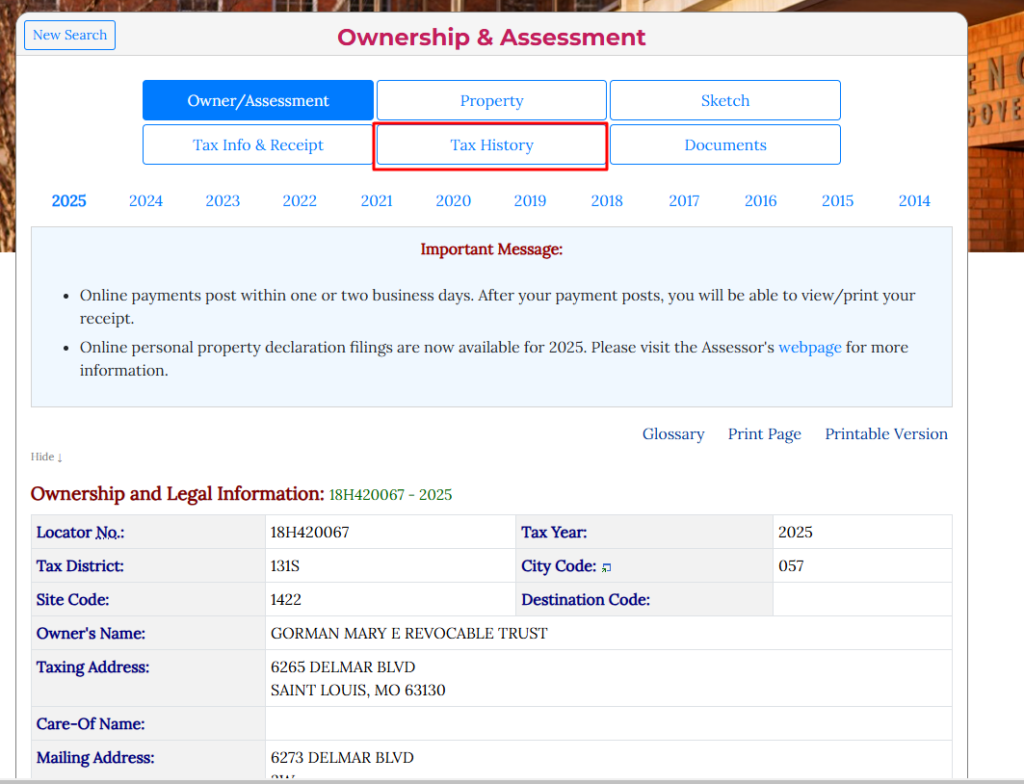

The website will now display information about the property located at that address, including its location on a map, property details, and potentially other relevant information. After the property appears in the search results, click on the “Details” link. This will show you the specific details of your property. Next, click on the “Tax History” link.

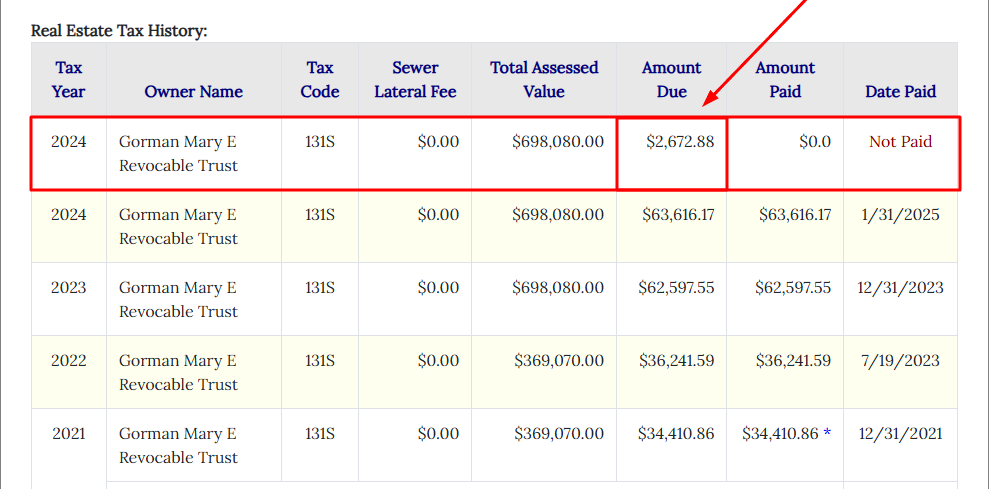

This will allow you to view your previous tax invoices & any unpaid tax invoices for that property.

St Louis County Tax Lookup By Name (Personal)

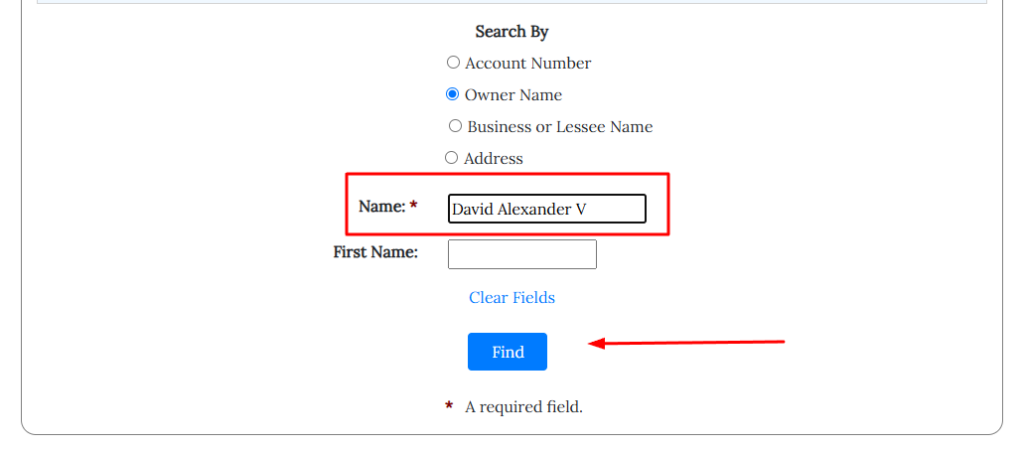

Go to the St. Louis County, Missouri website. You will find multiple search options. Choose the option to search by name. Type the name you want to search for, for example “David Alexander V”.

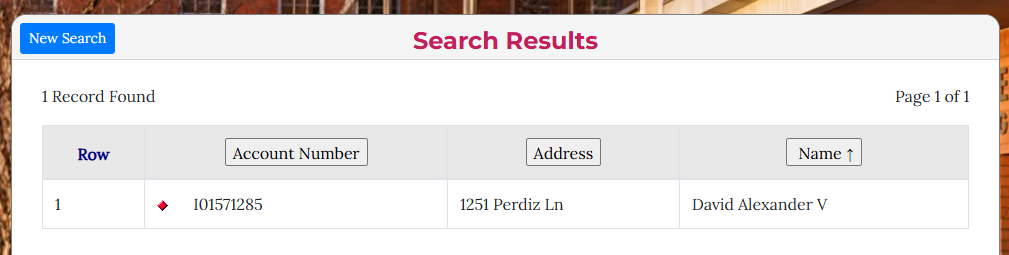

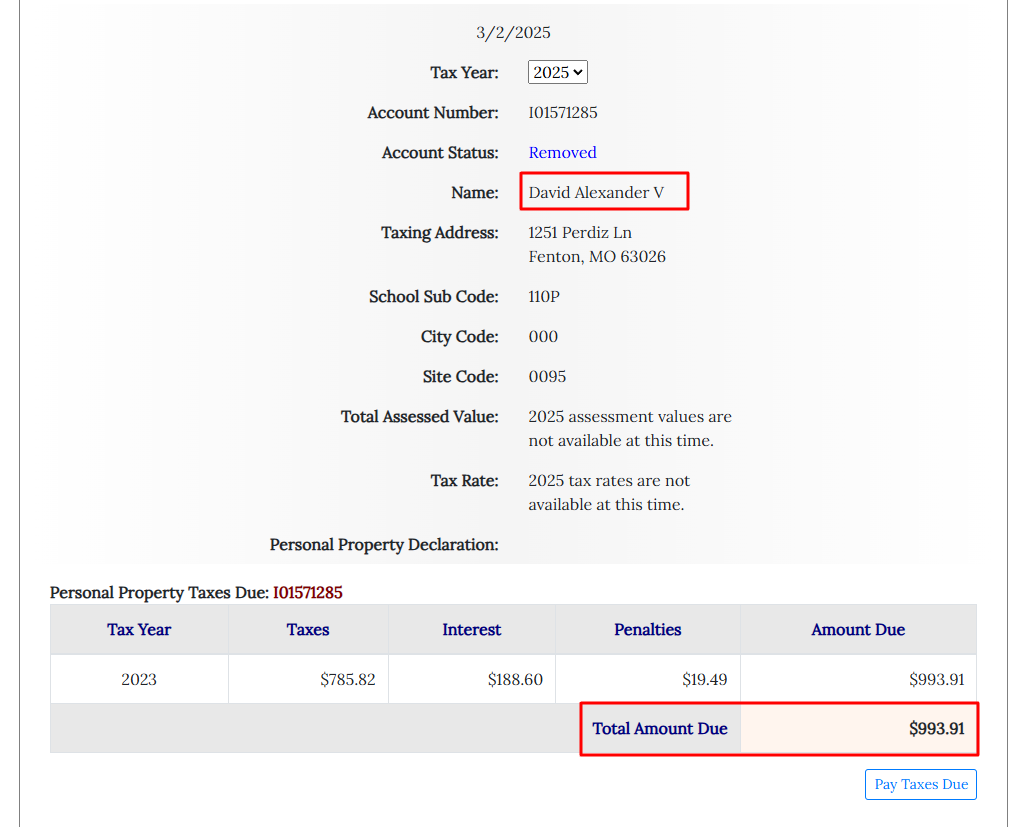

Click on the search button. You will see accounts that match the name you entered. Look for the account with your name and click on it to view the details.

How to pay the property and personal taxes after finding the tax amount?

There are several ways to pay your property tax in St. Louis County, Missouri, after finding out the amount you owe.

How to Pay tax online through a Credit card or EFT in St. Louis County.

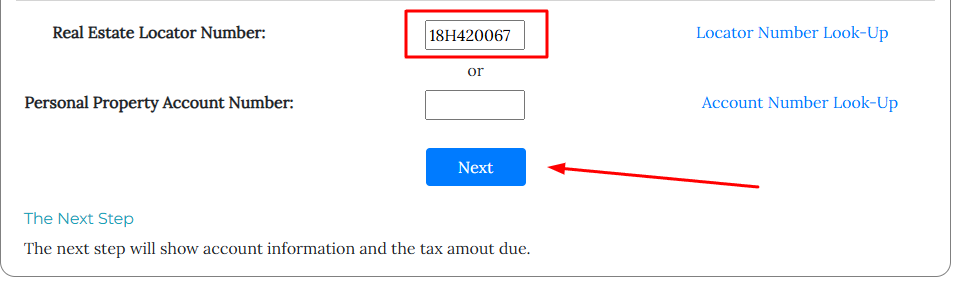

Online: This is the fastest way to pay and get a receipt. Online payments are processed within two business days, and you can print a receipt as soon as your payment is processed. You can pay directly from your checking or savings account without any extra fees. Go to St. Louis County, Missouri Online Tax Payments website. Enter your property locator number that you found in the tax details and click next.

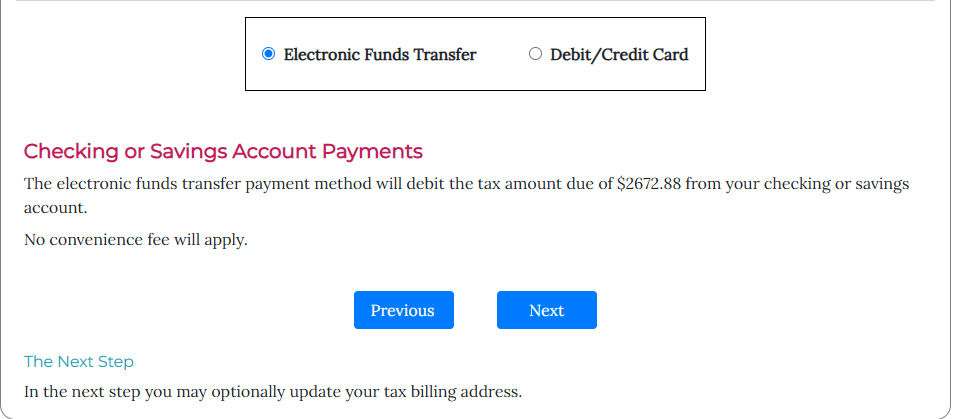

You now have two payment options: electronic fund transfer or debit/credit card. Choose the option that best suits your needs and click ‘Next’. Then enter the required details and pay your tax. This is the easiest way to complete the payment process. Credit card payments are accepted, but a convenience fee will be charged by a third-party provider. This fee will be shown to you before you complete your transaction.

How to Pay your Tax By Phone in St. Louis County.

Pay your property tax over the phone by calling 1-877-309-9306. You can use a credit card for payment, but an additional fee will be charged by a separate company. Once your payment is complete, you can print a receipt from the website.

How to Pay your Tax In Person in St. Louis County.

Visit one of the county’s locations & make the payment using cash, a personal check, or a money order. You will receive a receipt at the time of payment.

How to Pay your Tax Drop Tt Off in St. Louis County.

There are drop boxes located in the lobby of the county offices. You can drop off your payment (no cash) & include your tax bill or other identifying information to ensure your payment is credited correctly. After your payment is processed, you can print a receipt from the website.

How to Pay your Tax by Mail in St. Louis County.

Be aware of the postmark date. Taxes must be paid or postmarked by December 31 of the year they are billed. Envelopes postmarked after December 31 will be considered late payments & late charges will apply.

St Louis County Tax Payment Deadlines

St. Louis County has two payment deadlines for property taxes each year. The first payment, known as the First Half Payment, is usually due by May 15th. The second payment, called the Second Half Payment, is typically due by October 15th. These dates apply to the majority of property owners in the county, but it’s always a good idea to double-check the specific due dates for your property to avoid any late fees or penalties.

St Louis County Penalties for Late Payments

St Louis County charges fees for late property tax payments. The longer you delay paying, the higher the fees become. Check the back of your property tax statement to see the specific fees for late payments.

St Louis County Obtaining Tax Receipts

Getting Tax Payment Receipts in St. Louis County:

Online: After paying your taxes, you can print or download a receipt through the St. Louis County Property Tax website.

In-Person: You can visit the county offices and ask for a printed receipt.

By Mail: Contact the Collector of Revenue’s office and request that a receipt be mailed to you.

Conclusion

Paying property taxes in St. Louis County is an easy task when you have the correct details. By knowing what taxes you need to pay, checking your statements online, and choosing the most convenient way to pay, you can make sure you pay on time and avoid any extra fees. Whether you are paying for your home or business property, you can pay online by mail or in person. This makes the process simple.

If you need more help, visit the official St. Louis County tax website or contact the Collector of Revenue’s office.

If you have any questions about How to pay property tax in St. Louis County or need assistance, feel free to Contact Us or leave a comment on this post. We’re here to help!

0 Comments