A Pennsylvania corporation search allows you to find information about businesses registered in the state. It is a useful tool for verifying the legal status and details of a company. The search is provided by the Pennsylvania Department of State and can be accessed online for free.

Through this search, you can check if a business name is already in use view the current status of a registered entity, and find publicly available information such as the business address and registered agent. Conducting a corporation search is important for legal purposes, due diligence, or simply to confirm the legitimacy of a business before engaging with it.

How to Perform a Pennsylvania Corporation Search Online?

Business Entity Search

1: Visit the Pennsylvania Business Entity Search website.

https://file.dos.pa.gov/search/business

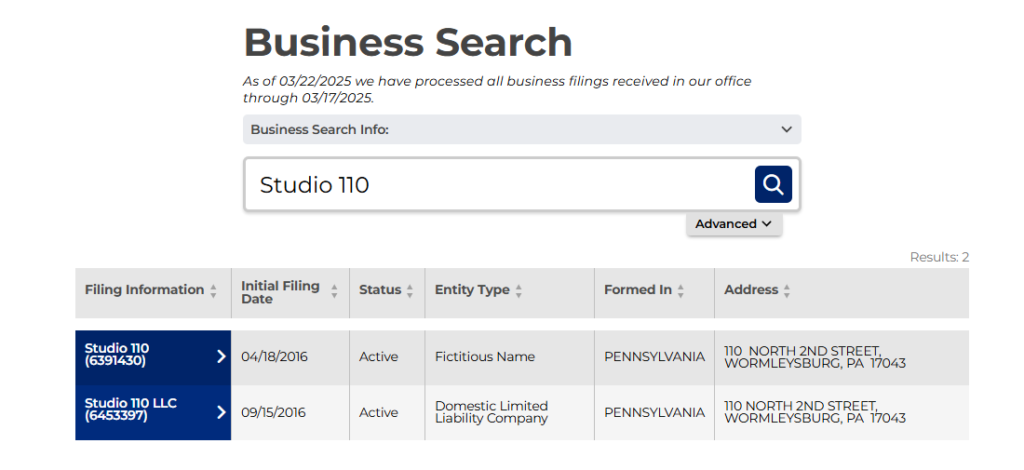

2. Searching for a Pennsylvania corporation online is a straightforward process. There are two methods available. If you want to perform a basic search, simply enter the word or phrase you want to find in the Pennsylvania Secretary of State’s business search tool and then click the “Select” button. For instance, if you want to search for “Studio 110” to register your LLC, you can check if the name is already taken or not.

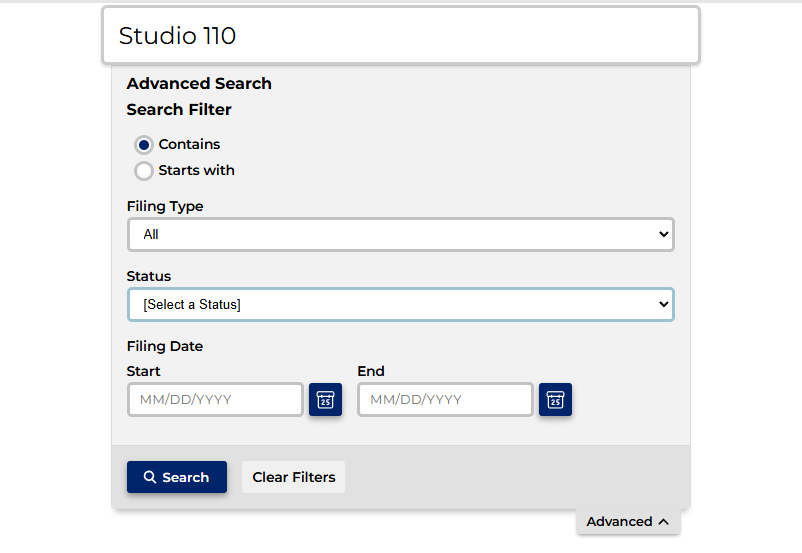

On the search page, you’ll see an option labeled “Advanced.” Click on it to access additional search filters. The advanced search allows you to narrow down your search by specifying certain criteria.

For example, you can choose whether the corporation name should contain specific words or start with particular letters. You can also filter the results based on the filing type the corporation’s status (active or inactive), or the filing date range. After selecting the desired search parameters, click on the “Search” button. The website will then display a list of corporations matching your criteria.

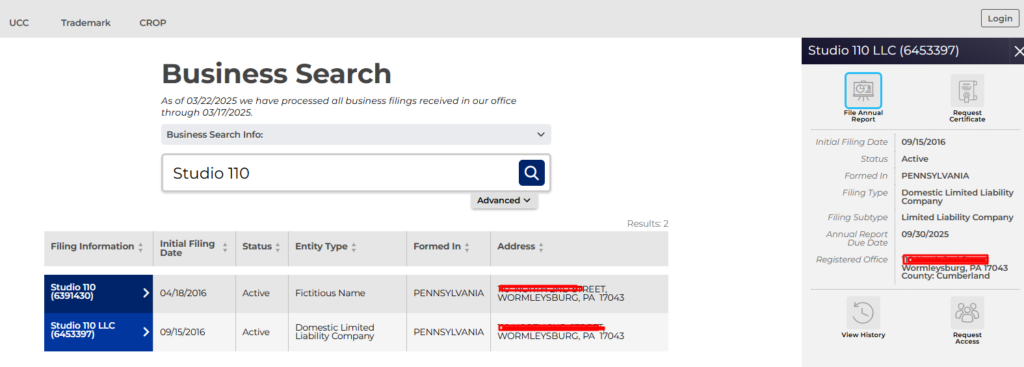

Review the results carefully to find the corporation you’re looking for. It’s important to note that the search results may include corporations with similar names or variations. If you’re unsure about a particular corporation, you can click on its name to view additional details, such as the address, filing date, and registered agent information. By following these simple steps, you can easily search for and find information about Pennsylvania corporations online, making it convenient to access the necessary details for your purposes.

3: Finding a Pennsylvania Corporation Online After searching, look at the results below the search box. Each row shows details about a Pennsylvania corporation. Click on the corporation’s name to see more information. The columns provide: Filing Information: Details about the corporation’s registration. Initial Filing Date: When the corporation was first registered.

Status: If the corporation is active or inactive. Entity Type: The type of corporation such as a business corporation or non-profit. Formed In: The county where the corporation was formed. Address: The corporation’s registered address.

By contacting the Pennsylvania Secretary of State

Performing a corporation search online is a straightforward process. To find information about a company registered in Pennsylvania, you need to contact the Pennsylvania Secretary of State’s office. This office handles business and corporation matters in the state. You can reach them by phone at (717) 787-1057 or by email at RA-CORPS@pa.gov.

Their mailing address is Office of the Secretary, 401 North Street Room 302 Harrisburg, PA 17120. If you prefer to call, their phone number is (717) 787-6458. By contacting this office, you can obtain the details you need about any corporation registered in Pennsylvania.

Free vs Paid Corporation Search Tools in Pennsylvania

Searching for a Corporation in Pennsylvania There are two ways to search for a corporation in Pennsylvania: using free tools or paid services.

Free Corporation Search Tools in Pennsylvania: The Pennsylvania Department of State offers a free online search tool called the Corporations Online Search. This tool allows you to search for basic information about corporations registered in the state, such as the business name, entity number, and current status (active or inactive).

Paid Corporation Search Services: In addition to the free search tool, there are paid services that provide more comprehensive information about corporations. These services often offer additional details like the names of officers and directors registered agent information, filing history, and other public records.

When to Use a Paid Service: While the free search tool from the state is useful for basic information, you may need to use a paid service if you require more detailed or in-depth information about a corporation. Paid services can be particularly helpful if you need to conduct due diligence, research potential business partners or competitors, or obtain comprehensive reports on a company’s history & operations.

It’s important to note that both free & paid services only provide publicly available information about corporations. If you need access to non-public or confidential information you may need to seek alternative sources or obtain proper authorization.

Common Name Search Tips and Filters in Pennsylvania

Searching for Pennsylvania Corporations by Name When looking for a Pennsylvania corporation online, you can use the company’s name to find it. Here are some helpful tips & filters to make your search easier: Use the full legal name of the corporation if you know it. This will give you the most accurate results. If you’re unsure of the full name, try searching with just the main keywords or the first few words.

Check for alternate spellings or abbreviations of the company name. Some corporations may be listed differently than you expect. Look for filters on the search page that let you narrow down by location (city or county) business type, or other criteria. This can help you find the right corporation faster.

Pay attention to the corporation’s status – active inactive, or another designation. This will tell you if the business is currently operating or not. If you still can’t find the corporation you’re looking for, try broadening your search terms or checking other online databases for more information. With some patience & the right search techniques, you should be able to locate details on most Pennsylvania corporations easily online.

What if the Pennsylvania business entity name is already taken?

Searching for a Pennsylvania Corporation Online When starting a new business in Pennsylvania, it’s crucial to ensure that the desired company name is available and not already in use by another entity. Here’s how you can perform a Pennsylvania corporation search online:

1. Visit the Pennsylvania Department of State’s website (https://www.corporations.pa.gov/Search/CorpSearch).

2. On the Corporation Search page, enter the proposed business name or a keyword related to the name in the search field.

3. Select the appropriate search criteria such as “Entity Name Contains” or “Entity Name Starts With,” depending on how you want to search for the name.

4. Click the “Search” button. The search results will display a list of existing corporations or business entities registered with the Pennsylvania Department of State that match your search criteria.

If the name you want to use is already taken you will need to choose a different name for your corporation. It’s important to note that even if the exact name you want is available, you may need to consider variations or similar names to avoid potential confusion or trademark infringement issues.

It’s always a good idea to conduct a thorough search and consult with legal professionals to ensure compliance with state and federal laws. If the desired name is available, you can proceed with the incorporation process by filing the necessary documents and paying the required fees with the Pennsylvania Department of State.

How to Find Out Who Owns a Business in Pennsylvania?

To determine the owner of a business in Pennsylvania, you can follow these steps:

1. Visit the Pennsylvania Department of State’s online business entity search tool. This tool allows you to search for businesses registered in the state.

2. Enter the name of the business you want to look up. You can also search by other criteria, such as the business entity number or the name of the owner.

3. The search results will provide you with information about the business, including the name of the owner or owners, the business address, and the type of business entity (such as a corporation limited liability company, or partnership).

4. If the business is a corporation or limited liability company, the search results will typically list the names of the officers or managers as well as the registered agent who is responsible for receiving legal documents on behalf of the business.

5. If the business is a partnership, the search results will list the names of the partners.

6. If you need additional information about the business or its owners, you can contact the Pennsylvania Department of State’s Corporation Bureau or visit their office in Harrisburg. It’s important to note that some businesses, such as sole proprietorships may not be registered with the state, and their ownership information may not be publicly available through the Department of State’s database.

Business Registration Requirements in Pennsylvania

Registering a business in Pennsylvania involves several steps.

First, you need to choose a unique name for your business that complies with state regulations.

Next, decide on the legal structure of your business, such as a sole proprietorship, partnership, limited liability company (LLC), or corporation.

Once you have chosen a structure appoint a registered agent who will receive official documents on behalf of your business. This agent must have a physical address in Pennsylvania.

After that, file the necessary formation documents with the state, such as articles of incorporation or organization. Obtain any required licenses and permits for your specific business type and location. This may include professional licenses sales tax permits, or zoning permits.

Also register your business for state and federal taxes, such as income tax, employment tax, and sales tax. Finally, comply with any local requirements, such as obtaining a business license from your city or county.

Following these steps will ensure that your business is properly registered & compliant with Pennsylvania laws.

Pennsylvania Business Registration Cost

Registering a Business in Pennsylvania: Costs Explained In Pennsylvania, when you first register a business like a Limited Liability Company (LLC), you need to pay a filing fee of $125.

However, there are also ongoing costs you need to consider, such as annual report fees and potential local licensing fees. These costs can vary depending on the type of business you have & where it is located.

Initial Registration Fees: – Certificate of Organization (for LLCs): $125 –

Incorporation (for corporations): $125 –

Foreign Registration Statement (for out-of-state businesses): $250 –

Fictitious Name Registration (for businesses operating under a different name): $70 –

Trademark Registration: $50 Ongoing Costs: –

Annual Report: $70 for LLCs –

Decennial Report: $70 (this requirement will end in 2024) –

Local Business Licenses: Fees vary depending on the city or town – Registered Agent Service: $100-$300 per year (optional)

Other Important Points: – Veterans and Reservists Exemption: Pennsylvania waives the filing fee for small businesses started by veterans and reservists. – Online Filing: You can register your business online through the PA Business One-Stop Shop. – No State-Level Business License: Pennsylvania does not require a general state-level business license, but you may need licenses or permits specific to your industry. –

Annual Report: Starting in 2025, all Pennsylvania LLCs must file an annual report every year. – Limited Liability Partnerships (LLPs) and Limited Liability Limited Partnerships (LLLPs): In 2025, these entities will have to pay an annual fee of $470 multiplied by the number of general partners as of December 31, 2024.

Choosing the Right Types of Business Entities You Can Register in Pennsylvania

Selecting the Appropriate Business Structure for Registration in Pennsylvania When starting a new venture in Pennsylvania, it is crucial to carefully consider the various business entity options available. Each type of entity offers distinct advantages & disadvantages in terms of liability protection, taxation, & operational requirements.

Here is a straightforward explanation of the common business structures in Pennsylvania:

Sole Proprietorship: This is the simplest form of business ownership, where there is no legal distinction between the business and the individual owner. The owner is personally responsible for all debts & liabilities of the business. Taxes are reported on the owner’s personal income tax return.

Partnership: A partnership involves two or more individuals or entities sharing ownership profits, and liabilities of the business. Partners are personally liable for the debts and obligations of the partnership. Partnerships can be general or limited, with limited partners having restricted liability and management responsibilities.

Limited Liability Company (LLC): An LLC is a hybrid entity that combines the liability protection of a corporation with the tax treatment and operational flexibility of a partnership or sole proprietorship.

Members of an LLC are generally not personally liable for the company’s debts and obligations.

Corporation: A corporation is a separate legal entity from its owners (shareholders). It offers the highest level of liability protection but also has more complex formation and operational requirements. Corporations can be either for-profit or non-profit entities.

When choosing a business structure, it is essential to consider factors such as personal liability exposure taxation implications management structure, & future growth plans.

Consulting with legal and financial professionals can help ensure that you select the most suitable entity for your specific business needs and goals.

Conclusion

Searching for business entities in Pennsylvania is a straightforward process. First identify the type of business you are looking for, such as a corporation limited liability company, or partnership. Next, visit the Pennsylvania Department of State’s website & navigate to the business entity search page. Here, you can enter the name of the business or other relevant details to find the information you need.

The search results will provide you with the business’s registration status, address, & other important details. It’s a simple and efficient way to access public records on businesses operating in the state of Pennsylvania.

If you’re having trouble searching for business entities in Pennsylvania, need to perform bulk searches, or want to find contact information for business owners in the state — feel free to reach out to us anytime. We’re here to help! Contact us

0 Comments